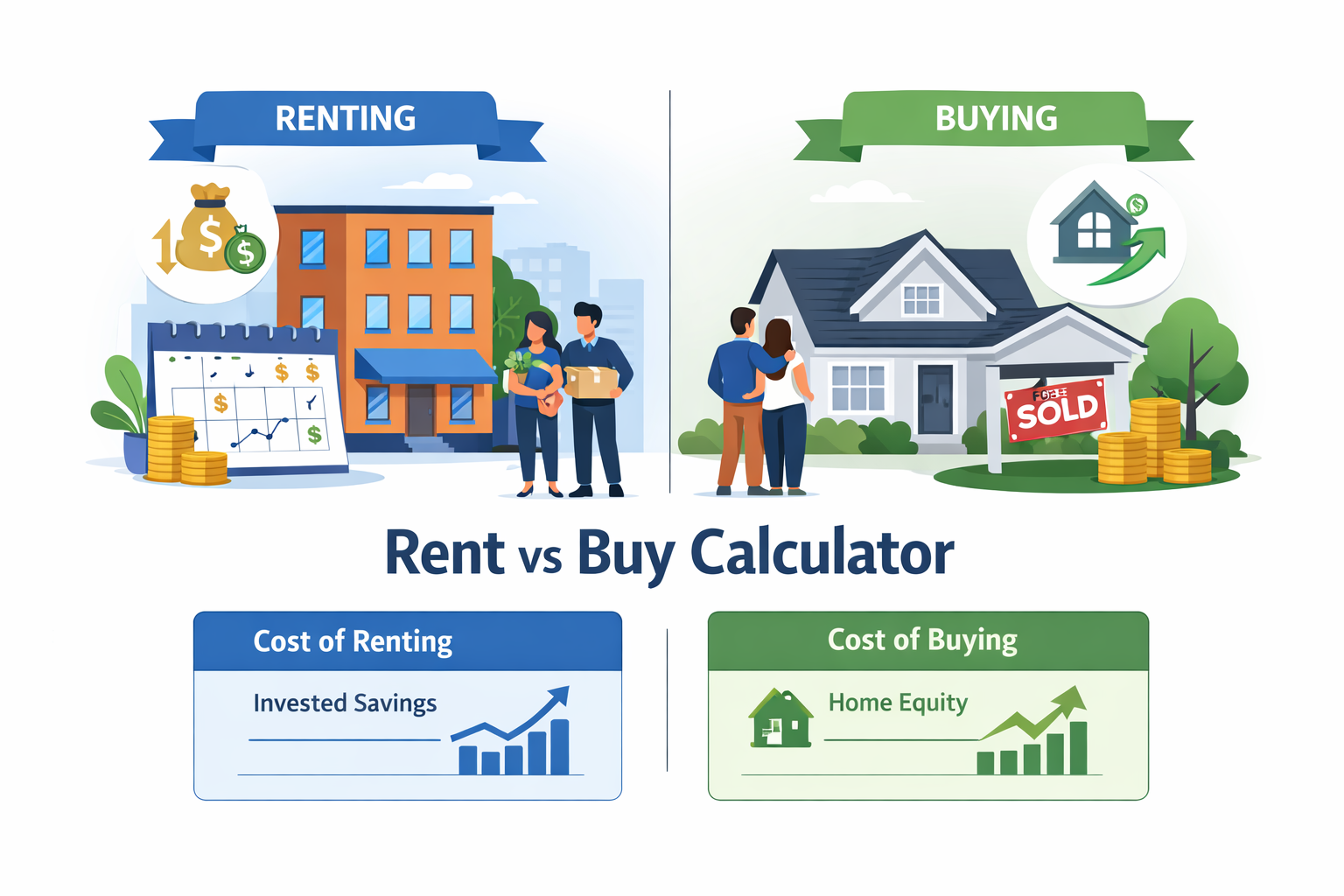

Free Rent vs Buy Calculator (US) – Should You Rent or Buy a Home?

Use our free Rent vs Buy Calculator for the US market to compare the long-term financial impact of renting a home versus buying one. This tool helps you understand which option may lead to higher estimated net worth based on your assumptions.

The Rent vs Buy Calculator models common real-world factors such as rent growth, mortgage payments, home appreciation, property taxes, maintenance costs, and investment returns. It is designed to support scenario testing—not to predict outcomes or provide financial advice.

What this Rent vs Buy Calculator does?

This Rent vs Buy Calculator compares two paths over a selected time horizon: continuing to rent and investing the difference, or buying a home and building equity over time. The results are based entirely on the inputs you provide and simplified assumptions.

- Estimates total costs of renting versus owning over time

- Models home equity growth and net sale proceeds

- Accounts for rent increases, maintenance, taxes, and transaction costs

- Shows the estimated break-even point where buying may outperform renting

Rent vs Buy Calculator

Compare the estimated financial outcome of renting versus buying a home over a chosen time horizon. This is an educational financial tool—not financial advice.

Inputs

Tip: Run multiple scenarios (higher/lower appreciation, different rent growth, different investment return).

- Buying costs include mortgage payment, property tax, insurance, maintenance, HOA, and transaction costs.

- Renting costs include rent (growing annually) and renter’s insurance.

- Renting side invests the down payment + any monthly savings when renting is cheaper than buying.

- Buying side builds equity and ends with net proceeds after selling costs and remaining mortgage payoff.

How to Use This Rent vs Buy Calculator

This Rent vs Buy Calculator is designed for quick, realistic scenario testing. Start with conservative assumptions and run 2–3 variations.

Step-by-step

- Enter your current rent and expected annual rent increase.

- Enter a target home price, down payment %, mortgage rate, and loan term.

- Adjust homeowner costs like property tax, insurance, maintenance, and HOA fees.

- Set your expected home appreciation and investment return assumptions.

- Review the “Winner,” net worth difference, and the break-even year produced by this Rent vs Buy Calculator.

What the results mean

The goal of this Rent vs Buy Calculator is not to predict the future—it’s to quantify trade-offs. If the net worth difference is small, the decision may be more about lifestyle, stability, and flexibility than pure dollars.

Methodology (simplified model)

- Renting: total rent and renter’s insurance are tracked, and the model invests the down payment and any monthly savings when renting is cheaper.

- Buying: the model estimates mortgage amortization, property tax, insurance, maintenance, and HOA, and ends with net sale proceeds after selling costs and remaining mortgage payoff.

- Break-even year: the first year where buying net worth exceeds renting net worth.

Good scenarios to test

For better decisions, run this Rent vs Buy Calculator with (a) lower appreciation, (b) higher maintenance, and (c) different mortgage rates. If buying only wins under very optimistic assumptions, that’s useful information.

If you want deeper precision, we can expand this Rent vs Buy Calculator to include PMI, tax impacts, and inflation-adjusted (real) returns.

FAQ

Short, practical answers to common questions.

What does this calculator actually compare?

Does it include taxes (mortgage interest deduction, SALT, etc.)?

Why does “investment return” matter for renting?

What inputs change the answer the most?

Is buying always better if I stay longer?

Educational Disclaimer

InvestingLab.com provides educational financial tools and simulations only. We do not provide financial, tax, or legal advice. Results are illustrative and depend on user-provided assumptions.