Trump Net Worth: How it’s Estimated, What Drives it, and Why the Number Varies..

Educational breakdown of net worth estimation, real estate valuation, leverage, and brand-driven income—without hype or predictions.

When people look for Trump net worth, they usually want a single number. In reality, any public “net worth” figure for a high-profile business owner is best understood as a range, not a precise fact—because it depends on how assets and liabilities are valued at a specific moment in time.

From a financial adviser’s perspective, the more useful question isn’t “What is the exact number?” but “What makes the estimate go up or down?” Net worth is simply assets minus liabilities, but the challenge is that many real-world assets (especially private real estate and brand-related businesses) are not priced daily like stocks.

This post explains how Donald Trump’s net worth is estimated, why reported figures can differ across publishers, and what everyday investors can learn about net worth tracking from high-visibility examples.

Trump Net Worth Explained: The Short Version

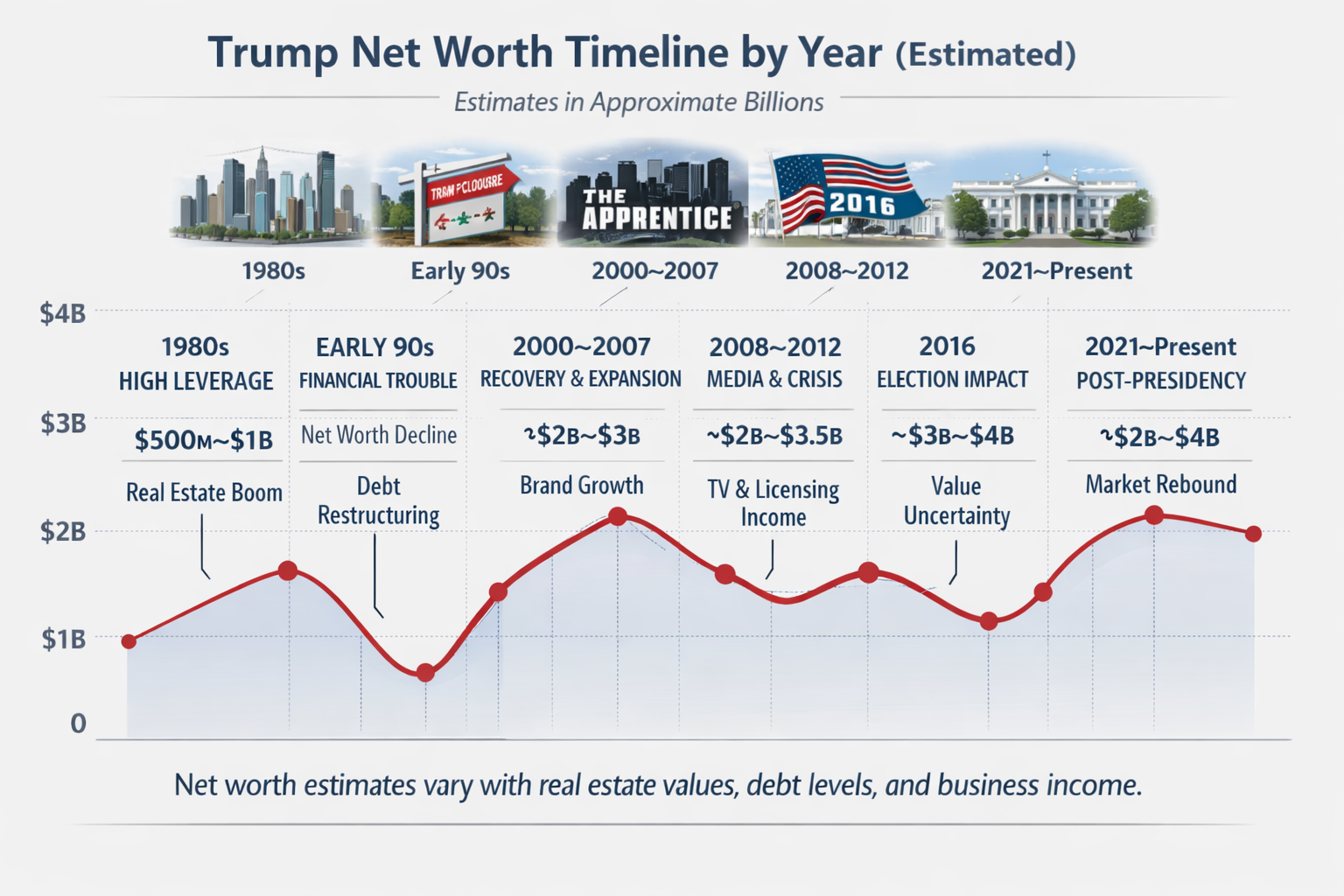

The “Trump net worth” is an estimate built from two moving parts: asset values (especially real estate and business interests) minus liabilities (property loans and other obligations). Because many assets are private and illiquid, reputable estimates can differ.

We break down why values vary, how leverage affects net worth swings, and how you can apply the same net worth framework to your own finances. If you want to calculate your personal baseline, use our Net Worth Calculator.

Image note: Trump Net Worth Timeline (illustrative, educational).

What “Trump Net Worth” Really Means

Net worth is a snapshot: total assets (what someone owns) minus total liabilities (what someone owes).

For individuals with a simple balance sheet—cash, retirement accounts, a home mortgage—net worth is relatively straightforward.

For large business owners with private holdings, net worth can be far more sensitive to assumptions.

A key point: net worth is not cash. Someone can have a very high net worth while keeping a relatively small amount of liquidity, because the value is tied up in operating assets such as properties, businesses, and long-term holdings.

Why Trump Net Worth Estimates Vary Across Sources

1) Real estate is illiquid and valuation-driven

Much of the discussion around Donald Trump net worth is driven by real estate valuation. Unlike public equities, real estate doesn’t have a live market price every second. Estimated values often depend on:

- Net operating income (NOI) and expected cash flow

- Capitalization rates (cap rates) used to convert income into value

- Comparable sales and market demand

- Interest-rate conditions that affect property pricing

2) Leverage can amplify changes

Another major reason Trump net worth is frequently debated is the role of debt. Real estate portfolios commonly use borrowing. Debt can accelerate wealth building when asset values rise, but it can also increase net worth volatility when values fall or financing conditions tighten.

3) Brand value is hard to price

Many focus on questions like “How much is the Trump brand worth?” Brand value is not a single, objective number. It can be estimated using licensing revenue, comparable brand deals, and business cash flows, but the final figure can vary substantially depending on methodology.

A Practical Breakdown: Assets That Typically Drive the Estimate

Public discussion of Trump net worth tends to cluster around a few broad asset categories. While specific asset lists evolve over time, the underlying categories remain consistent in how they influence net worth estimation:

Real estate and operating properties

Hotels, office buildings, golf courses, and similar assets are typically valued using income-based methods and market comparisons. These assets can create large swings in net worth when assumptions change.

Business interests and licensing

Licensing and brand-related business income can contribute meaningfully to cash flow, but the valuation depends on how durable and predictable that income is assumed to be.

Liquidity and investments

Even high-net-worth individuals can have a balance sheet where liquid assets are a smaller percentage of total wealth. That makes the “net worth” number less about spendable cash and more about long-term equity value.

Liabilities Matter: The Side of Net Worth Most People Ignore

A surprisingly common query is: “How much debt does Trump have?” The reason people ask is that liabilities can change the interpretation of wealth. Two people can own similar assets, but if one uses significantly more borrowing, their net worth (and risk profile) can look very different.

In a net worth framework, liabilities typically include:

- Mortgages and commercial property loans

- Other secured borrowing

- Business-related obligations

- Any personal liabilities reported in disclosures

This is why some estimates differ widely: one methodology might use a higher property valuation while another might apply a more conservative value and emphasize debt exposure more heavily.

Net Worth vs Income: Another Common Misunderstanding

People often mix up net worth with annual income. Net worth is a balance-sheet concept; income is a cash-flow concept. A person can increase income without materially increasing net worth (for example, if expenses rise or debt grows), and net worth can rise without income increasing (for example, if asset values appreciate).

If you want to understand the “why” behind net worth changes, it helps to think like a CFO: What changed in assets? What changed in liabilities? What changed in cash flow assumptions?

What Everyday Investors Can Learn From Trump Net Worth

Lesson 1: Concentration increases volatility

A net worth heavily tied to one asset class (like real estate) may experience larger swings as market assumptions change. Diversification often reduces volatility, even if it also reduces “headline” growth during boom periods.

Lesson 2: Leverage is powerful—and risky

Debt can accelerate wealth creation, but it increases sensitivity to interest rates, refinancing cycles, and economic downturns. Understanding your personal leverage (mortgage, auto loans, credit cards) is a crucial part of financial stability.

Lesson 3: A net worth number is only useful if you can track it consistently

For most people, the best net worth strategy is not chasing a perfect estimate—it’s building a repeatable system and monitoring trends. If you’d like to calculate your own net worth quickly, you can use our Net Worth Calculator to list assets and liabilities in clear categories and see your baseline.

FAQ

Common questions people ask about Trump net worth and net worth estimates.

Why do different sources report different Trump net worth numbers?

Is net worth the same as how much cash someone has?

What is the biggest driver of Trump net worth estimates?

How can I calculate my own net worth accurately?

Do net worth estimates predict future outcomes?

Disclaimer

This article is for general educational and informational purposes only. It does not provide financial, tax, or legal advice. Net worth figures discussed publicly may vary by source and methodology, and may change over time. For assumptions and limitations, see How Calculators Work and Disclaimer.