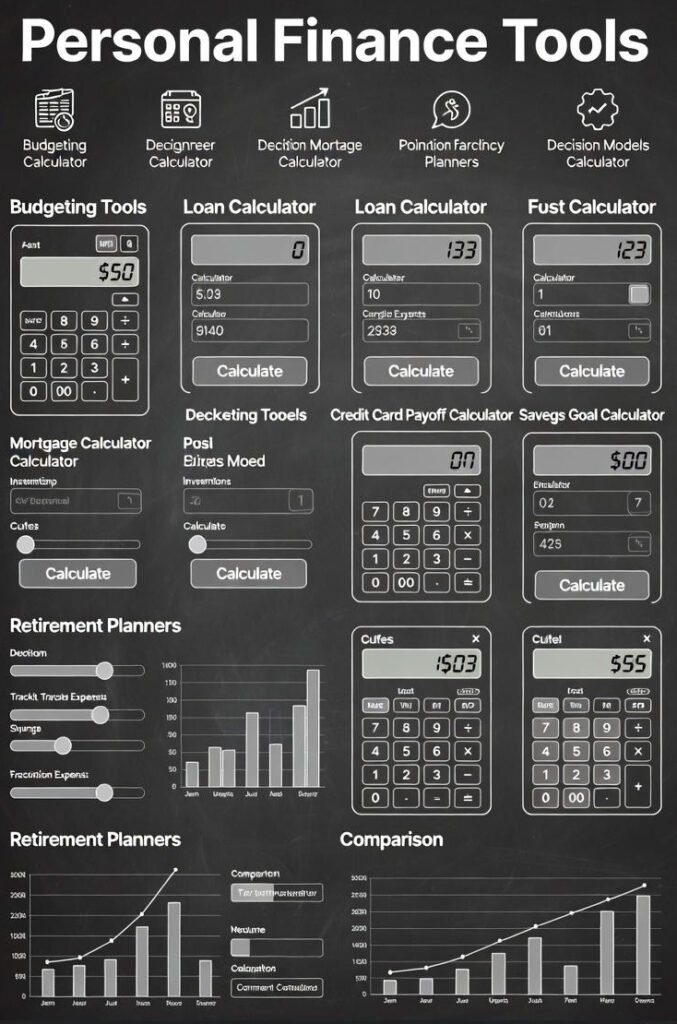

What Are Personal Finance Tools?

A beginner-friendly explanation of financial tools, calculators, and decision models.

If you are trying to manage money more effectively, you may have come across the term personal finance tools. These tools are designed to help individuals understand financial decisions, compare options, and explore possible outcomes using clear inputs and simplified models.

Personal Finance Tools Explained

Personal finance tools are digital resources that help people organize financial information and evaluate decisions such as budgeting, saving, investing, debt repayment, and retirement planning. Many modern tools take the form of personal finance calculators that allow users to enter their own numbers and instantly see how outcomes change. It could be termed as finance simulators as well.

Unlike advice-driven platforms, educational finance tools focus on clarity and comparison. They are designed to show trade-offs rather than recommend specific actions.

Common Types of Personal Finance Tools

There are many types of free personal finance tools online. Each serves a different purpose depending on the financial question being explored.

- Budgeting tools – Used to track income and expenses, categorize spending, and understand monthly cash flow.

- Budget calculators – Simple calculators that total income and expenses to highlight surplus or deficit.

- Retirement planning tools – Help estimate future savings growth and retirement income needs.

- Retirement calculators – Focus on contribution levels, time horizons, and withdrawal assumptions.

- Financial decision tools – Compare two or more options, such as paying off debt versus investing.

- Financial planning calculators – Broader tools that combine multiple assumptions to model long-term scenarios.

How Personal Finance Calculators Help Decision-Making

The primary benefit of personal finance calculators is that they make abstract financial concepts more concrete. Instead of guessing, users can test “what-if” scenarios by adjusting inputs such as income, expenses, interest rates, or time horizons.

These tools are especially useful for understanding opportunity cost. For example, a calculator can help illustrate how redirecting extra cash toward debt repayment may compare with investing that same amount over time.

Educational calculators do not predict outcomes. Instead, they highlight sensitivity—showing how results change when assumptions change.

Online Finance Calculators vs Manual Planning

Before online tools were widely available, financial planning often required spreadsheets or manual calculations. While spreadsheets remain powerful, online finance calculators lower the barrier to entry by automating formulas and visualizing results.

This accessibility makes financial tools more approachable, especially for beginners who want to understand concepts before committing to detailed planning.

Educational resources from the U.S. Securities and Exchange Commission (Investor.gov) also emphasize the importance of understanding basic financial principles before making investment decisions. They also help you understand what are personal finance tools doing to make lie-easier.

Examples of Personal Finance Tools in Practice

At InvestingLab.com, we focus on educational tools that help users explore financial trade-offs. Examples include:

- Budget Planner Calculator – for organizing income and expenses.

- Debt vs Invest Calculator – for comparing competing uses of extra cash.

- Retirement Planner Calculator – for estimating long-term retirement scenarios.

You can browse all available tools in our personal finance tools directory.

FAQ

Common questions about personal finance tools.

Are personal finance tools free to use?

Do personal finance calculators provide financial advice?

What are personal finance tools easy to start with?

Educational Use Only

Personal finance tools on InvestingLab are provided for educational and informational purposes only. Results are based on user inputs and simplified assumptions.

Please review our Disclaimer and How Calculators Work for details.